MEFO Bills and Money Printing

This is the third of a series of articles on post-pandemic markets. We look at a surprising example of debt financing that transformed the German economy in the nascent Nazi-era. The topic may be unpalatable but the latest variants of money-printing may leave no stone unturned from history.

MEFO Bills and Money Printing

While there is much debate around history and its context at present we should nevertheless remain attuned to its lessons. Human behaviour is tediously repetitive but the pattern is often masked by new innovations. The method may change but the motivation and outcome remains the same.

It is especially true for the re-packaging of government debt in a post-crisis period which we previously covered in Merry-go-round of Money. With the collapse in tax revenues one can guarantee that Treasury departments will be dipping into the history books for inspiration. Just as celebrity chefs de-construct classic dishes and present them with a modern twist we may see some long-forgotten financial schemes re-surface. This article highlights one such example.

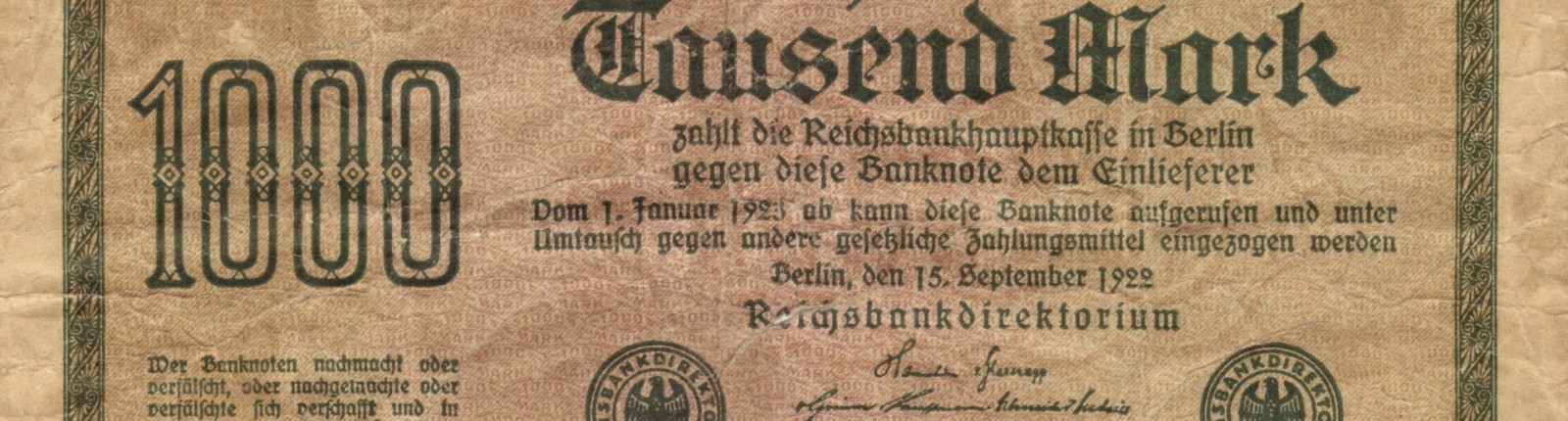

Following Germany’s defeat in the Great War retaliatory reparations took their toll on the economy. Hyperinflation impoverished the country in 1921 followed by an equally traumatic episode of austerity a decade later. While the ascent of National Socialism is often associated with the turmoil of inflation, the later period of austerity was much more relevant to public at the time; as was the threat of Communism which the movement sought to counter.

The 1932 famine engineered by Stalin in the Ukraine – known as the Holodomor - was a reminder that Marxism was not the Utopia it promised. It inspired George Orwell to write Animal Farm after meeting the British journalist Gareth Jones who witnessed the genocide and reported on it. Jones was allegedly murdered by Soviet agents in 1935 for embarrassing Stalin. Orwell’s final book - 1984 -remains as relevant as ever with the unrelenting encroachment of the state into our daily lives.

One technique utilised by the Nazi regime not only overcame the reparations burden but also transformed the economy. At a time when other countries were dragging themselves from the Great Depression, Germany was running at full capacity. From a standing-start in 1933 and unemployment rate of 25% the economy shifted to full employment in just 5 years. Their effective growth rate was 7% per annum over that period; something not seen until China’s resurgence in recent decades. How was this possible without causing inflation or having access to foreign currency reserves?

The re-armament and autobahn programme was funded by the issuance of bills or promissory notes by a government front-company called MEFO (Metallurgische Forschungsgesellschaft). This was a dummy organisation whose bonds were state-guaranteed and could circulate as a form of money. The 90-day maturity date of the bills was rolled-over repeatedly so were rarely redeemed, although they could be exchanged for cash. They were effectively government IOU’s.

Each bill was issued to pay invoices for manufactured goods so there was an equilibrium between the amounts of money created for an equivalent value of products. Inflation was therefore not an issue as there was never an imbalance between too much money chasing too few goods. The bills had a miraculous impact on the economy, albeit the jobs and output generated was engineered for sinister motives with war aims in mind.

Another twist was that funds paid to overseas recipients for imported materials had to be spent on German goods, thereby recycling the capital back onshore. The scheme’s creator Hjalmar Schacht – dubbed Hitler’s Banker – was later dismissed in 1939 and later ended up in Dachau concentration camp. After the war he was put on trial at Nuremberg for crimes against peace but was acquitted.

While the extremes of the 1930’s are unlikely to be repeated we must be mindful that economic chaos is a breeding ground for political factions on the Far Right and Radical Left. Given that we have already undergone a decade of austerity the public will no longer stomach further stringent measures.

Governments will likely print money by the back door and let their currencies decline, with the inherent risk of inflation down the road. We have already seen the UK Chancellor implement stimulative stamp duty cuts and vouchers for restaurant consumption; likely aimed at re-employing an army of youth who had previously worked in service industries. These policy measures may well be justified; it is easier to revive businesses while they are still viable rather than attempt resuscitation after bankruptcy.

While creative destruction is the mainstay of capitalism there is inevitably a long lead time and the public’s patience is wearing thin post-pandemic. Either way, it looks like money printing is already underway. Markets scent a whiff of currency debasement so capital is seeping out of the seams in search of havens from inflation. The prime beneficiaries are speculative stocks, precious metals and alternative currencies which have been bubbling up in anticipation.

Whether or not the equivalent of MEFO Bills are resurrected remains to be seen but it is a reminder that governments can be highly inventive in the pursuit of self-preservation and can decree money to be whatever form they dictate.

Disclaimer

Past performance is not a guide to future returns. Please note that the value of your investments can go down as well as up and you could get back less than your original investment.

The information and views expressed in this blog is for general information purposes only and is provided by Gower Financial Services Limited ("Gower", "we"). While we endeavour to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the blog for any purpose.

The blog is based on the opinions of Gower and therefore does not reflect the ideas, ideologies, or points of view of any organisation with which Gower is, and may in the future potentially be affiliated with.

This blog does not constitute investment or financial advice or a representation that any investment strategy or service is suitable or appropriate to your individual circumstances.

Gower will not be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of the information contained within this blog.

Gower Financial Services Ltd is licensed and regulated by The Guernsey Financial Services Commission. Company registration number 37312 and has its registered office at Suite E3, Sarnia House, East Building, Le Truchot, St Peter Port, Guernsey, GY1 4EN.